Company Overview

Ameritus, LLC is a uniquely positioned commercial real estate investment and services firm based in Chicago. The firm invests in and operates commercial real estate with a focus on the greater Chicago marketplace, and serves as the local operating partner to institutional investors, private equity firms, and high net worth individuals. Founded in 1999, Ameritus offers a core set of real estate services for its capital partners and third-party clients which creates and maintains value for investors in the office, industrial, and retail asset classes. Ameritus feels strongly about the alignment of interests, and as such, has the willingness and significant capability to invest in real estate projects along with its capital partners.

The Ameritus Team consists of talented individuals who have successfully developed and managed businesses at both national real estate firms and entrepreneurial investment boutiques. At these firms, our key principals have been involved in over $4 Billion of commercial real estate transactions and investments. Individually, each member of the firm contributes a valuable and unique skill set with core competencies in leasing, management, and investment acquisitions. When working in concert, these complimentary capabilities serve as the foundation of Ameritus’s dynamic commercial real estate platform designed to provide a high level of service to both our investors and clients.

Jeb Scherb

Jeb is a co-founder of Ameritus, LLC and has grown the company from a boutique services provider to an investment sponsor for institutional and high net worth real estate investors. Jeb has 20 years of commercial real estate experience and started his career with Frain Camins & Swartchild. With a focus on office and industrial transactions in the Chicago CBD and River North submarkets, Jeb has arranged over $350M of lease and investment transactions. At Ameritus, Jeb is responsible for the acquisition, development, and implementation of the business plans of all investments, including leasing, capital projects, and operations. Jeb is the co-founder of Young Office Brokers Association, and is a past recipient of the Frank Mahoney Award for Excellence in Brokerage given by the Association of Industrial Real Estate Brokers. Jeb is a graduate of St. Lawrence University, holds the CCIM designation, and is an Illinois licensed real estate broker.

Bert Scherb

Bert is a co-founder of Ameritus, LLC and has handled over 2,000 sale and leasing transactions and developed over 1 million square feet of office and retail properties throughout his career. Bert has founded and grown several real estate platforms in Chicago including Hawthorne Realty and Midwest Real Estate Exchange which he eventually sold to the NYSE listed Grubb & Ellis. At Grubb & Ellis, Bert served as the President of the Midwest Region and was a member of the firm’s Board of Directors. Bert also served as the head of office leasing at Frain Camins & Swartchild prior to forming Ameritus. Bert is responsible for various property management activities for the firm and focuses on fundraising and investor relations for Ameritus. Bert is a graduate of the University of Denver, is the past president of the Realty Club of Chicago, and is a founder and the first president of the Chicago Office Leasing Brokers Association.

Benjamin Nummy

Ben has over 20 years of institutional real estate experience having held various senior level investment positions at Massachusetts Mutual Life Insurance Company, Morgan Stanley, and Equibase Capital Group. At Ameritus, Ben is responsible for acquisitions, investment management, and maintaining relationships with Ameritus’s equity and lending partners. Internally he handles all capital markets transactions, fund administration and investor reporting. Throughout his career, Ben has invested over $1.75B of capital in debt, mezzanine, and equity structures throughout the United States and in all commercial property types. Ben is a graduate of Syracuse University and earned his MBA at Northwestern University’s Kellogg Graduate School of Management. He holds the CCIM designation and is Series 7 and 63 FINRA licensed

Bob Budington

Bob has 20 years of commercial real estate experience with a diverse background in leasing, financial analysis, asset management, and property acquisitions and dispositions. He has negotiated leases in excess of $200 million in value, assisted in acquisitions and dispositions of $300 million in assets, and implemented marketing and leasing programs for 3 million square feet of assets. Prior to joining Ameritus, Bob has held positions with Jones Lang LaSalle, Golub & Company, Colliers International and Avison Young. At Ameritus, Bob leads a tenant representation business and is instrumental in the leasing activity of Ameritus-sponsored investments. Bob is an Illinois licensed real estate broker and is a graduate of Cornell University.

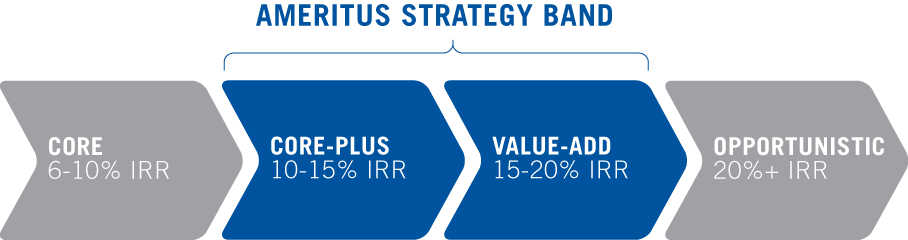

Ameritus prides itself on its proven ability to create value, and more importantly, its creative intelligence to find value. Ameritus’s investment interests span the Value Add and Core Plus sectors of commercial real estate. Ameritus pursues investment opportunities generally ranging from $15M to $50M for the acquisition of single assets and loans (larger for portfolios) where it can create risk-adjusted returns through re-tenanting, physical and operational enhancements, market repositioning, or financial restructuring. Ameritus has the experience to structure its investments as a fee acquisition, mezzanine loan, or debt purchase. We are firm believers that real estate is a local business and as such focus on a select set of Midwest markets in which to invest.

Ameritus also believes that strong relationships are the key to a successful strategy in real estate investment. The principals of the firm have developed a significant network of deep relationships with local brokers, owners, tenants, contractors, and lenders over their many years of experience. These relationships allow the firm to successfully engage and pursue both on and off-market transactions. The Firm’s strong relationship with capital partners is also a hallmark of its strategy. By partnering with institutional investors, family offices, and private equity firms, Ameritus operates with the confidence that all its investments are well capitalized, and as such, can perform throughout all market cycles.

205 West Wacker

Having acquired the asset in 2013 with a large private equity fund, Ameritus is currently renovating and repositioning the 270,000 square foot, art deco office building.

211 West Wacker

Chicago, IL • Ameritus

Ameritus acquired 211 West Wacker, a boutique 19-story Class C office building, with a group of high net worth investors as a 150,000 square foot building in distress.

Marcey Building

With several private investors, Ameritus purchased a 2 story, 100,000 sq.ft. industrial building within the densely populated, upscale Lincoln Park neighborhood.